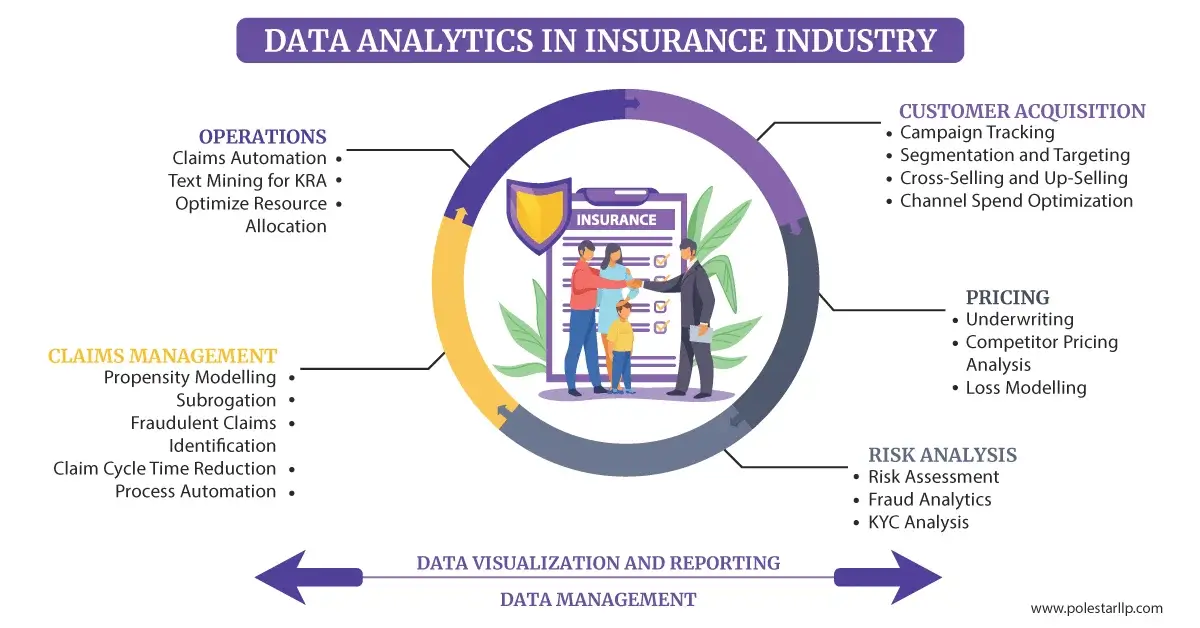

Data analytics and insights enable smarter insurance marketing decisions by allowing insurers to precisely identify profitable customer segments, optimize pricing, personalize marketing efforts, and improve customer acquisition and retention. These capabilities stem from analyzing vast and diverse datasets, applying predictive modeling, and leveraging customer lifetime value (CLV) analysis to allocate marketing resources efficiently and tailor products to customer needs.

Key ways data analytics drives smarter insurance marketing decisions include:

-

Identifying Profitable Market Segments: Advanced analytics goes beyond traditional demographics to segment customers based on behaviors, preferences, and risk profiles, enabling targeted marketing campaigns that focus on high-value prospects.

-

Predictive Modeling: Using historical data, insurers forecast future customer behaviors such as renewal likelihood and claim rates, allowing marketing to prioritize segments with higher profitability and retention potential.

-

Customer Lifetime Value (CLV) Analysis: CLV helps insurers understand the long-term revenue potential of different customer groups, guiding marketing investments toward nurturing relationships with the most valuable customers.

-

Personalized Pricing and Product Offers: Analytics enables dynamic pricing models (e.g., pay-as-you-go) and personalized insurance products based on individual risk and buying preferences, improving conversion and customer satisfaction.

-

Enhanced Customer Acquisition and Retention: By analyzing customer data and interactions, insurers can design targeted acquisition strategies and proactive retention programs, reducing churn and increasing loyalty.

-

Improved Customer Engagement: Data-driven insights allow insurers to deliver relevant content, timely communications, and personalized recommendations, fostering deeper customer relationships.

-

Operational Efficiency and Claims Optimization: Analytics streamlines claims processing and fraud detection, indirectly supporting marketing by improving customer experience and trust.

-

Climate and Risk Analytics: Incorporating environmental and geographic data helps insurers adjust marketing and pricing strategies to reflect localized risks, enhancing relevance and competitiveness.

-

Use of AI and Machine Learning: These technologies enhance predictive accuracy and enable real-time decision-making in underwriting and marketing, further refining targeting and personalization.

Overall, data analytics transforms insurance marketing from broad, intuition-based efforts into precise, data-driven strategies that improve profitability, customer satisfaction, and competitive advantage.