Using Follow-Up Surveys and Net Promoter Scores to Identify Review Candidates

Follow-up surveys and Net Promoter Scores (NPS) are widely used tools for gathering actionable feedback from candidates about their experience with your hiring process. When applied thoughtfully, these methods can help organizations identify both strengths and areas for improvement, as well as pinpoint candidates who may be willing to provide detailed reviews or testimonials.

How Net Promoter Score (NPS) Works in Candidate Experience

- Survey Question: Candidates are asked, “How likely are you to recommend our company to other job seekers?” on a 0–10 scale.

- Response Categories:

- Promoters (9–10): Highly satisfied, likely to recommend your company.

- Passives (7–8): Satisfied but not enthusiastic, unlikely to actively promote or criticize.

- Detractors (0–6): Dissatisfied, likely to share negative feedback.

- Calculation:

[ \text{cNPS} = \left(\frac{\text{Number of Promoters}}{\text{Total Respondents}} - \frac{\text{Number of Detractors}}{\text{Total Respondents}}\right) \times 100 ] Passives are counted in the total but not in the score calculation. - Interpretation: Scores range from -100 (all detractors) to +100 (all promoters). A positive score is good; 50+ is excellent.

Identifying Review Candidates

Promoters are your best candidates for providing positive reviews, testimonials, or referrals. They are already inclined to speak favorably about your organization and are more likely to respond to follow-up requests for detailed feedback or public reviews.

Detractors can also be valuable for identifying pain points in your process. While they are less likely to provide positive public reviews, their feedback is crucial for diagnosing issues and making improvements.

Passives may not be as vocal, but with the right engagement, they could be converted into promoters through targeted improvements based on their feedback.

Best Practices for Follow-Up Surveys

- Timing: Send surveys after key milestones (e.g., after an interview or a rejection) to capture fresh impressions.

- Survey Design: Keep it short, include the NPS question, and add open-ended follow-up questions to gather qualitative insights (e.g., “What did you like most about our process?” or “How could we improve?”).

- Engagement: Personalize invitations, assure confidentiality, and explain how feedback will be used to improve the candidate experience.

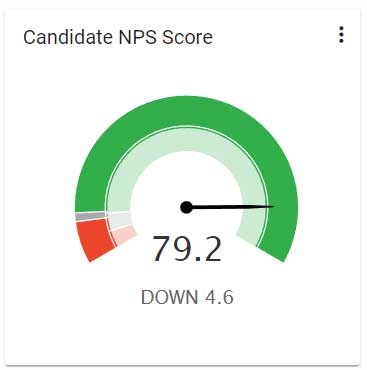

- Action: Analyze trends, address concerns raised by detractors, and replicate what works for promoters. Regularly track your cNPS to measure the impact of changes over time.

- Follow-Up: Reach out to promoters for testimonials or referrals. Consider following up with detractors to understand their concerns in more depth, which can inform process improvements.

Example Workflow

- Send NPS Survey: After a candidate completes a key stage in your hiring process, send a brief survey with the NPS question and a follow-up open-ended question.

- Categorize Responses: Identify promoters, passives, and detractors based on their scores.

- Analyze Feedback: Look for patterns in qualitative responses to understand what drives satisfaction or dissatisfaction.

- Engage Promoters: Invite promoters to share their experience in more detail, provide a testimonial, or refer others.

- Address Detractors: Use their feedback to identify and rectify issues in your hiring process.

- Monitor Trends: Track your cNPS over time to assess the effectiveness of changes and continue refining your candidate experience.

Summary Table: Candidate Categories and Follow-Up Actions

| Category | Score Range | Likelihood to Recommend | Follow-Up Action |

|---|---|---|---|

| Promoter | 9–10 | High | Request testimonials, referrals, reviews |

| Passive | 7–8 | Neutral | Monitor; potential to convert to promoter |

| Detractor | 0–6 | Low | Investigate pain points, improve process |

Key Takeaways

- NPS surveys are a simple, quantitative way to gauge candidate satisfaction and identify those most likely to provide positive reviews.

- Follow-up questions yield qualitative insights that help you understand the “why” behind the scores, guiding meaningful improvements.

- Promoters are your best source for positive reviews and referrals; detractors highlight areas needing attention.

- Regular measurement and action on feedback lead to continuous improvement in the candidate experience.

By systematically applying NPS and follow-up surveys, organizations can not only measure candidate satisfaction but also proactively identify and engage candidates willing to advocate for their employer brand.