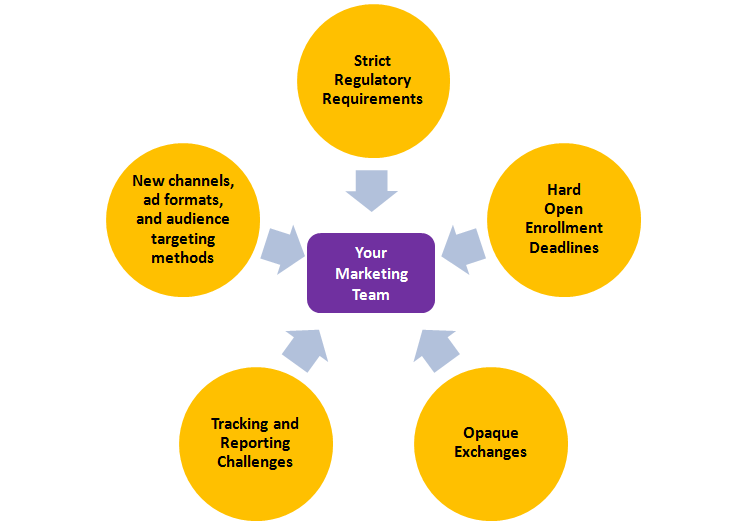

Building trust and credibility through online insurance marketing content relies primarily on creating valuable, educational, and transparent content that addresses real customer concerns and simplifies complex insurance topics. This approach positions insurers as trusted advisors rather than just service providers.

Key strategies include:

-

Developing informative content such as blog posts, guides, videos, infographics, and webinars that explain insurance concepts clearly and answer common questions. This helps clients feel confident and informed, which builds trust.

-

Using educational content to shift from salesperson to trusted advisor, by addressing real-world concerns (e.g., claims process, coverage scenarios) and sharing relatable stories about how insurance has helped others.

-

Incorporating SEO and keyword optimization to ensure content is discoverable by potential customers searching for insurance information online.

-

Leveraging social proof such as customer testimonials, reviews, case studies, and endorsements on websites and social media platforms to demonstrate credibility and positive client experiences.

-

Engaging on social media to build community, share thought leadership, respond to inquiries, and participate in industry conversations, which enhances transparency and trust.

-

Providing interactive tools like calculators or quizzes that help users evaluate their coverage needs, offering personalized value and engagement.

-

Offering ongoing education through seminars, workshops, or community events to foster face-to-face connections and deepen relationships.

-

Ensuring website optimization for user experience, clear calls-to-action, and easy access to essential information to support trust-building during initial interactions.

-

Using diverse content formats and credible sources, including licensed expert content and multimedia, to stand out and maintain high-quality, engaging content.

In summary, the most effective online insurance marketing content builds trust by educating customers, simplifying insurance complexities, showcasing real client success stories, and actively engaging with the audience through multiple channels and formats.