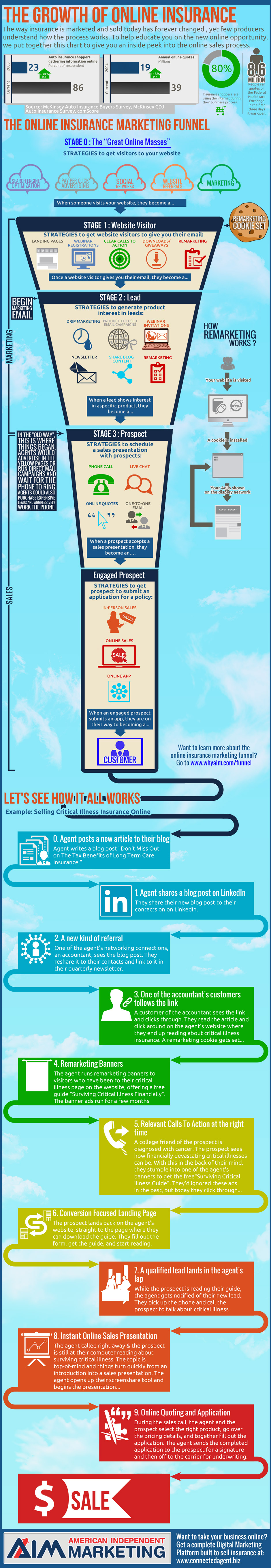

Understanding the Insurance Online Marketing Funnel

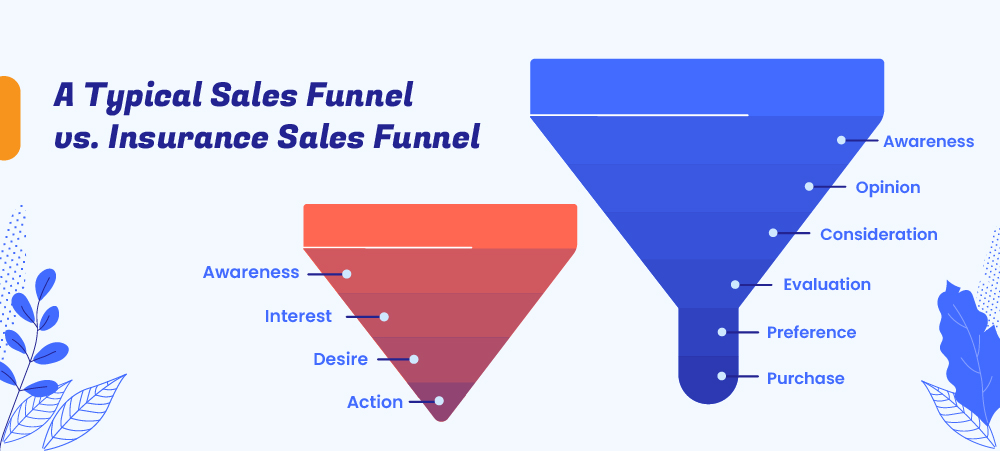

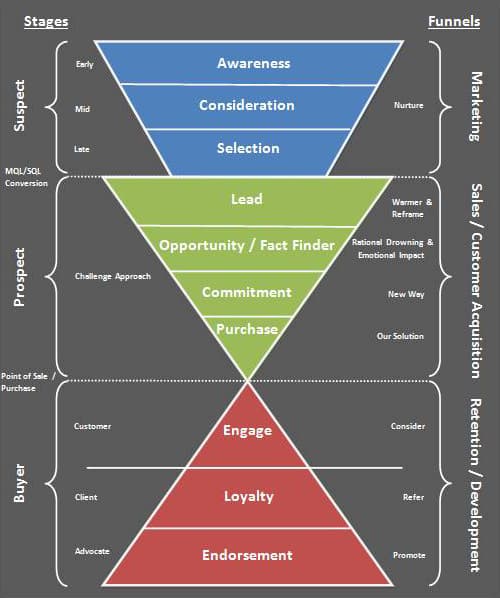

An online marketing funnel for insurance sales is a structured process that guides potential customers from initial awareness of your brand and products through to conversion and, ideally, ongoing retention and referrals. Unlike simpler e-commerce funnels, insurance sales involve building trust over time, often requiring multiple touchpoints and a focus on education and relationship-building.

Key Stages of the Insurance Sales Funnel

| Stage | Goal | Strategies & Tactics |

|---|---|---|

| Awareness (Top) | Attract strangers, build brand trust | SEO, content marketing (blogs, videos), social media, local SEO, digital ads |

| Interest (Middle) | Nurture leads, educate, build trust | Lead magnets (e-books, guides), email campaigns, webinars, retargeting ads |

| Decision (Bottom) | Convert leads into clients | Online quote forms, chatbots, appointment scheduling, personalized offers |

| Retention (Post-Sale) | Keep clients, encourage renewals & referrals | Excellent service, follow-up, loyalty programs, cross-sell/upsell |

Building an Effective Insurance Sales Funnel

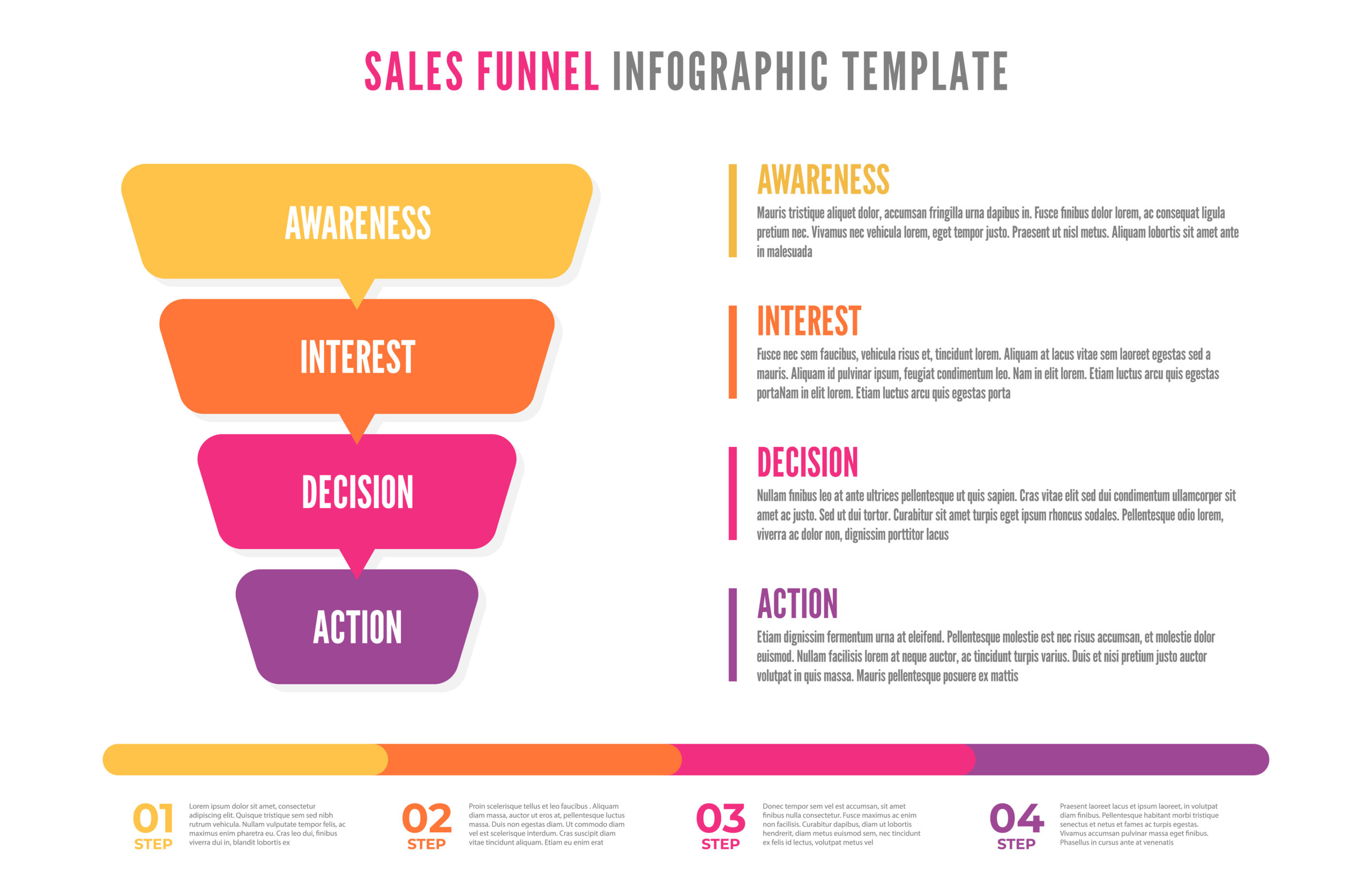

Attract (Awareness)

- Content Marketing: Publish articles, guides, and videos that answer common insurance questions and address industry trends.

- SEO: Optimize your website and content for search engines to attract organic traffic from people researching insurance options.

- Social Media: Engage your audience on platforms like LinkedIn, Facebook, and YouTube to increase visibility and trust.

- Local SEO & Ads: Target local searches (“insurance agent near me”) and use geo-targeted ads to reach potential clients in your area.

Nurture (Interest)

- Lead Magnets: Offer valuable resources (e.g., e-books, checklists) in exchange for contact information to build your email list.

- Email Campaigns: Send targeted, educational emails that nurture leads over time, emphasizing your expertise and the value of your products.

- Webinars & Workshops: Host live or recorded sessions to deepen engagement and demonstrate your knowledge.

- Retargeting: Use ads to stay top-of-mind with visitors who haven’t yet converted.

Convert (Decision)

- Online Forms: Make it easy for leads to request quotes or apply directly through your website.

- Chatbots & Live Chat: Provide instant assistance to answer questions and guide prospects through the application process.

- Appointment Scheduling: Use tools to let prospects book calls or meetings at their convenience.

- Personalized Offers: Tailor your messaging and offers based on the prospect’s behavior and needs.

Retain (Post-Sale)

- Follow-Up: Check in with clients after the sale to ensure satisfaction and address any concerns.

- Renewal Reminders: Proactively contact clients before policy renewal dates.

- Loyalty Programs & Referrals: Encourage repeat business and word-of-mouth referrals through incentives and excellent service.

- Cross-Sell/Upsell: Identify opportunities to offer additional coverage or products that meet evolving client needs.

Optimization Tips

- Speed-to-Lead: Respond quickly to inquiries—delays can cost conversions.

- Trust Signals: Highlight customer reviews, ratings, and testimonials to build credibility.

- Data-Driven Decisions: Use analytics to identify bottlenecks and optimize each stage of the funnel.

- Multi-Channel Approach: Integrate email, social, SEO, and paid ads for maximum reach and impact.

- CRM Integration: Use a CRM to track interactions, automate follow-ups, and manage leads efficiently.

Common Pitfalls to Avoid

- Neglecting the Middle Funnel: Many agents focus too much on attracting new leads and not enough on nurturing existing ones, even though nurtured leads often convert at higher rates.

- Overly Salesy Messaging: Insurance is a “Your Money or Your Life” (YMYL) decision—focus on education and trust-building rather than hard sells.

- Ignoring Retention: The lifetime value of a client includes renewals and referrals, so post-sale engagement is critical.

- Lack of Personalization: Generic messaging is less effective than content tailored to the prospect’s stage in the funnel and specific needs.

Conclusion

Creating and optimizing an online marketing funnel for insurance sales requires a strategic, multi-stage approach that prioritizes education, trust, and relationship-building at every step. By attracting the right audience, nurturing leads with valuable content, streamlining the conversion process, and maintaining strong post-sale relationships, insurance professionals can significantly improve client acquisition, retention, and overall business growth.